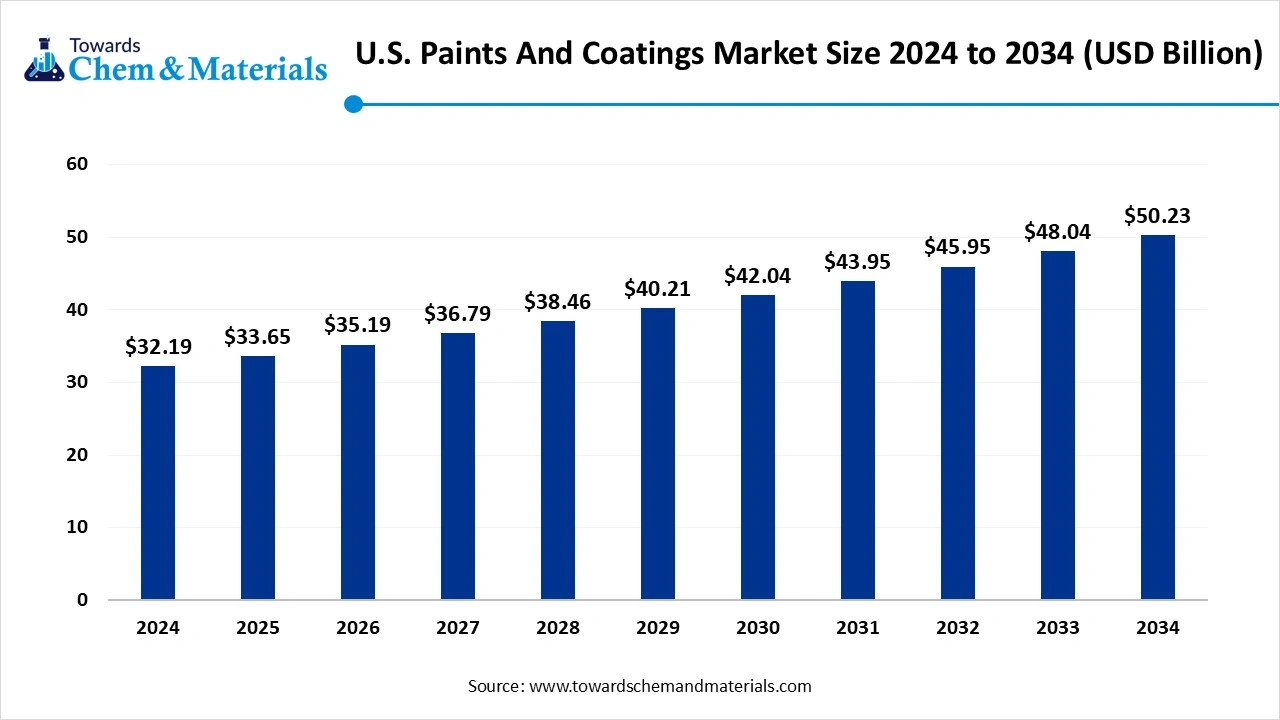

U.S. Paints & Coatings Market Size to Worth USD 50.23 Billion by 2034

According to Towards Chemical and Materials, the U.S. paints & coatings market size was reached at USD 33.65 billion in 2025 and is expected to be worth around USD 50.23 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.35% over the forecast period 2025 to 2034.

Ottawa, Sept. 23, 2025 (GLOBE NEWSWIRE) -- The U.S. paints & coatings market size was valued at USD 32.19 billion in 2024 and is anticipated to reach around USD 50.23 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.35% over the forecast period from 2025 to 2034. The growth of the market is driven by the rising demand for eco-friendly and low VOC paints and coatings is driving the growth of the market. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/5819

U.S. Paints and Coatings Market Overview

The U.S. paints and coatings market encompasses a wide range of products used for protection, finishing and decorating across residential, commercial, industrial and infrastructure settings. It is being driven by growing needs in construction and infrastructure, increasing vehicle production (especially electric vehicles), and other industries seeking enhanced durability and aesthetic performance. There is a notable trend towards sustainability, with low-VOC formulations, water-based technologies, and other environmentally friendly paint and coating products gaining preference. Technological advancements including the market forward. Consumer preferences for home improvement pressure are shaping product innovation and forcing greater adoption of sustainable and safer materials.

U.S. Paints And Coatings Market Report Highlights

- By resin type, the acrylic resins segment dominated the market with approximately 35% share in 2024. The dominance of the segment can be attributed to the increasing demand for automotive coatings.

- By technology, the water-based coatings segment held approximately 50% market share in 2024. The dominance of the segment can be linked to the rapid innovations in water-based coating technology.

- By function, the decorative/architectural coatings segment led the market by holding approximately 55% share in 2024. The dominance of the segment is owed to the growing popularity of DIY home enhancement projects.

- By application, the architectural segment dominated the market by holding approximately 50% share in 2024. The dominance of the segment can be attributed to the growing consumer demand for aesthetically pleasing coatings.

- By end-use industry, the building & construction segment held approximately 52% market share in 2024. The dominance of the segment can be linked to the ongoing population growth and urbanization in the country.

Buy Now this Premium Research Report at a Special Price Against the List Price With [Express Delivery] @ https://www.towardschemandmaterials.com/price/5819

U.S. Paints And Coatings Market Report Scope

| Report Attribute | Details |

| Market size value in 2025 | USD 33.65 Billion |

| Revenue forecast in 2034 | USD 50.23 Billion |

| Growth rate | CAGR of 7.35% from 2025 to 2034 |

| Base year for estimation | 2024 |

| Historical data | 2020 - 2024 |

| Forecast period | 2025 - 2034 |

| Quantitative units | Volume in Kilotons, Revenue in USD Million, and CAGR from 2025 to 2034 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | By Resin Type, By Technology, By Function, By Application, By End-Use Industry |

| Key companies profiled | The Sherwin-Williams Company; Axalta Coating Systems, LLC; PPG Industries, Inc.; RPM International, Inc.; BASF SE; 3M; Sika AG |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

U.S. Paints And Coatings Market Trends in 2024?

- Growing investment in sustainable and low-VOC formulations, driven by regulatory pressure and shifting consumer preferences.

- Increasing demand from the construction, infrastructure, and residential housing sectors, fuelling the use of protective, architectural, and decorative coatings.

- Technological innovation- development of UV curable, high performance, smart coatings, and enhancements in durability, weather ability, corrosion and chemical resistance.

- A shift toward water based and powder technologies, as alternatives to traditional solvent based coatings, in response to environmental concerns.

- Rise in automotive and transportation coatings demand, specially linked with electric vehicles and aesthetic/performance requirements.

U.S. Paints & Coatings Market Growth Factors

Can Cool Paints Help Beat the Heat?

Researchers are creating reflective paints that bounce back sunlight and release heat, helping buildings stay cooler without extra energy use. This not only lowers electricity bills but also makes cities more comfortable, boosting demand for advanced coatings in homes, offices and infrastructure.

Are Green Paints the Future?

Paint makers are shifting to low VOC and bio-based options that are safer for people and the planet. With new catalyst and natural ingredients, companies can meet stricter rules while still offering strong performance, making eco-friendly coatings a big growth driver.

Market Opportunity

Could Power Coatings Power Up Industrial Growth?

There’s a clear opportunity in expanding the use of powder coatings, specially given recent investment and facility expansions. For example, Kansai Helios Coatings established a new facility in Johnstown to ramp up the production of specialized powder coatings for automotive, industrial, and construction applications. This move reflects increasing demand for higher performance, environmentally friendly coatings powder systems typically emit fewer volatile organic compounds and have better transfer efficiency. That makes them not only attractive from a regulatory and sustainability standpoint but also from a performance and cost effectiveness perspective.

Is Automating Application a Game Change for Sustainability?

Another margining opportunity lies in automated, overspray free application technologies. Companies like BASF Coatings, in partnership with Renault Group and Durr, have developed a process for two tone vehicle painting in a single pass dubbed the overspray Free Application (OFLA). This automation significantly reduces waste, cuts down process time, the lowers environmental impact. Adopting such innovations across automotive and other industrial coating processes presents a compelling opportunity: it boosts efficiency and sustainability while reducing costs tied to waste and labour.

U.S. Paints And Coatings Market Limitations

- Regulatory and environmental pressures impose strict limits n volatile organic compound (VOC) emissions for paints and coatings, making compliance costly and slowing down innovation in certain solvent-based formulation.

- Fluctuating costs of raw materials such as resins, titanium dioxide, and solvents caused by energy price volatility, supply disruptions, or manufacturing plant closures squeeze profit margins and may raise end user prices.

U.S. Paints & Coatings Market Segmentation Insights

Resin Type Insights

Why Did Acrylic Resins Dominate the U.S. Paints And Coatings Market In 2024?

The acrylic resins segment dominates the U.S. paints and coatings market in 2024, because of their versatility, durability, and widespread use across architectural, automotive, and industrial applications. These resins are known for their ability to deliver strong adhesion, resistance to weathering and long-lasting colour retention, making them a preferred choice for both decorative and protective purposes. Their computability with water-based formulations also strengthens their position as sustainability continues to be a major focus for manufacturers and consumers.

The epoxy segment is projected to experience the fastest growth in the market between 2025 and 2034. They offer superior resistance to chemicals, abrasion, and extreme conditions, which makes them indispensable in industrial marine, and automotive coatings. As industries increasingly prioritize long lasting and protective solutions, epoxy resins are gaining momentum, particularly in applications where performance and reliability cannot be compromised.

Technology Insights

Why are Water Based Coatings Dominate the U.S. Paints And Coatings Market In 2024?

The water-based coatings segment held largest market share in 2024. Water based coatings dominate because of their ecofriendly profile and compliance with strict environmental regulations in the U.S. they emit lower levels of volatile organic compounds, aligning with consumer preferences for safer and greener solutions. In addition, advances in formulation technology have enhanced their performance, allowing them to rival solvent-based options in terms of durability, coverage, and finish quality, further cementing their dominance in the market.

The powder coatings segment is expected to grow at the fastest rate in the market during the forecast period. With no solvents and minimal waste, powder coatings significantly reduce environmental impact while offering excellent durability and finish consistency. Their increasing adoption in automotive, appliances, and industrial equipment manufacturing is driving rapid growth, particularly as companies invest in cleaner production technologies.

Function Insights

Why Do Decorative Coatings Segment Dominate the U.S. Paints and Coatings Market In 2024?

The decorative/ architectural coatings segment led the market in 2024. These coatings not only protect surfaces but also enhance aesthetic appeal, meeting the rising demand for vibrant, durable finishes in homes, offices, and public spaces. The growing trend of home improvement and renovation further boosts their usage, ensuring their continued prominence in the paints and coatings landscape.

The protective/industrial coatings segment is expected to grow in the 2025 to 2034, driven by the need to safeguard infrastructure, machinery, and vehicles from wear, corrosion, and harsh conditions. With industries like oil and gas, transportation, and heavy manufacturing requiring high performance solutions, protective coatings are becoming essential. Their ability to extend the life of critical assets positions them as a key growth driver for the future.

Application Insights

Why Is Architecture the Dominating the U.S. Paints and Coatings Market In 2024?

The architectural segment dominated the market in 2024. They serve both protective and decorative roles, ensuring durability while offering a wide range of finishes to suit modern design preferences. The combination or urbanization, commercial development, and residential remodelling continues to drive demand for architectural coating, reinforcing their leadership in the market.

The automotive and transportation segment is expected to grow at the fastest rate from 2025 to 2034, fuelled by the expansion of electric vehicle production, rising car ownership, and evolving consumer expectations for durability and aesthetics. Advanced coatings that provide corrosion resistance, scratch protection, and sleek finishes are increasingly sought after. This shift toward high performance automotive coatings is accelerating their adoption and market growth.

End Use Industry Insights

Why Does Building & Construction Dominate the U.S. Paints and Coatings Market In 2024?

The building & construction segment dominated the market in 2024. Growth in residential housing, commercial projects, and infrastructure upgrades across the U.S. ensures steady demand. Paints and coatings are indispensable for protecting structures from weathering while enhancing their appearance, making this industry the leading consumer of such products.

More Insights in Towards Chemical and Materials:

- Powder Coatings Market : The global powder coatings market size was valued at USD 17.25 billion in 2024 and is estimated to hit around USD 30.46 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.85% during the forecast period 2025 to 2034.

- Wood Coatings Market : The global wood coatings market size was valued at USD 12.09 billion in 2024 and is expected to reach around USD 20.36 billion by 2034, growing at a CAGR of 5.35% from 2025 to 2034.

- Green Coatings Market : The global green coatings market size was reached at USD 137.83 billion in 2024 and is estimated to surpass around USD 224.30 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.99% during the forecast period 2025 to 2034.

- Self-Healing Coatings Market ; The global self-healing coatings market size accounted for USD 3.21 billion in 2024 and is predicted to increase from USD 4.12 billion in 2025 to approximately USD 39.16 billion by 2034, expanding at a CAGR of 28.42% from 2025 to 2034.

- Nanocoatings Market : The global nanocoatings market size accounted for USD 16.93 billion in 2024 and is predicted to increase from USD 20.10 billion in 2025 to approximately USD 94.40 billion by 2034, expanding at a CAGR of 18.75% from 2025 to 2034.

- Pipe Coatings Market ; The global pipe coatings market size was valued at USD 9.95 billion in 2024 and is growing to approximately USD 16.84 billion by 2034, with a developing compound annual growth rate (CAGR) of 5.40% over the forecast period 2025 to 2034.

- Flat Glass Coatings Market : The global concrete floor coatings market size was reached at USD 3.91 billion in 2024 and is estimated to reach around USD 14.75 billion by 2034, growing at a compound annual growth rate (CAGR) of 14.20% during the forecast period 2025 to 2034.

- Concrete Floor Coatings Market : The global concrete floor coatings market size was valued at USD 5.07 billion in 2024 and is expected to reach around USD 8.53 billion by 2034, growing at a CAGR of 5.35% from 2025 to 2034.

- Functional Coatings Market : The global functional coatings market volume was reached at 7.95 million tons in 2024 and is expected to be worth around 13.14 million tons by 2034, growing at a compound annual growth rate (CAGR) of 5.15% over the forecast period 2025 to 2034.

- Low-VOC Coatings Market : The global low-VOC coatings market size was reached at USD 8.75 billion in 2024 and is expected to be worth around USD 15.16 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.65% over the forecast period 2025 to 2034.

- Sustained Release Coatings Market : The global sustained release coatings market size was reached at USD 675.85 million in 2024 and is expected to be worth around USD 1,373.63 million by 2034, growing at a compound annual growth rate (CAGR) of 7.35% over the forecast period 2025 to 2034.

- U.S. Industrial Coatings Market : The U.S. industrial coatings market size accounted for USD 28.19 billion in 2024 and is predicted to increase from USD 29.11 billion in 2025 to approximately USD 38.81 billion by 2034, expanding at a CAGR of 3.25% from 2025 to 2034.

- U.S. Mirror Coatings Market : The U.S. mirror coatings market size was valued at USD 185.19 million in 2024, grew to USD 194.65 million in 2025, and is expected to hit around USD 304.83 million by 2034, growing at a compound annual growth rate (CAGR) of 5.11% over the forecast period from 2025 to 2034.

- U.S. Diamond Coatings Market : The U.S. diamond coatings market volume was reached at 508.12 tons in 2024 and is expected to be worth around 945.31 tons by 2034, growing at a compound annual growth rate (CAGR) of 6.40% over the forecast period 2025 to 2034.

-

European Paints & Coatings Market : The European paints & coatings market size is calculated at USD 38.66 billion in 2024, grew to USD 39.99 billion in 2025, and is projected to reach around USD 54.27 billion by 2034. The market is expanding at a CAGR of 3.45% between 2025 and 2034.

U.S. Paints & Coatings Market Top Key Companies:

- The Sherwin-Williams Company

- Axalta Coating Systems, LLC

- PPG Industries, Inc.

- RPM International, Inc.

- BASF SE

- 3M

- Sika AG

Recent Developments

-

In May 2024, PPG has announced investment in advanced manufacturing capacity with a new plant in Tennessee, its first ne U.S. coatings facility in over a decade. The facility will support increasing demand from automakers and parts suppliers, and is expected to serve additional industrial and construction segments as production scales.

-

In November 2024, INX Group completed the acquisition of Coatings and Adhesive Corporation (C&A), a company known for specialty coatings and adhesive in North America. The merger brings together complementary product portfolios, strengthens raw material vertical integration, and provides a platform for innovation and more stable supply for performance averse applications.

U.S. Paints & Coatings Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global U.S. Paints & Coatings Market

By Resin Type

- Acrylic

- Alkyd

- Epoxy

- Polyester

- Polyurethane

- Fluoropolymer

- Vinyl

- Others (Silicone, etc.)

By Technology

- Water-Based Coatings

- Solvent-Based Coatings

- Powder Coatings

- UV-Cured Coatings

- High-Solids Coatings

By Function

- Decorative / Architectural Coatings

- Protective / Industrial Coatings

- Specialty Coatings (marine, aerospace, packaging, etc.)

By Application

- Architectural (residential, commercial, infrastructure)

- Automotive & Transportation

- Industrial Equipment & Machinery

- Aerospace & Marine

- Wood & Furniture

- Packaging (metal cans, plastics, etc.)

- Others (electronics, appliances)

By End-Use Industry

- Building & Construction

- Automotive & Transportation

- Aerospace & Defense

- Marine & Offshore

- Packaging & Consumer Goods

- Industrial & Machinery

- Others

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/price/5819

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor |

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.